Tax savings 401k contribution calculator

Retirement Calculators and tools. When you contribute 6 of your salary into a tax-deferred 401 k 2100your taxable income is reduced to 32900.

401k Calculator With Employer Match Tax Savings In 2022 The Real Law Of Attraction Manifestation Methods

The other major advantage of a 401k plan is the.

. Plan For the Retirement You Want With Tips and Tools From AARP. 35000 x 006 2100. Prior to any deductions Itemized Deductions.

To get there youll need to save. 10 Best Companies to Rollover Your 401K into a Gold IRA. Contributions made to the plan are deducted from taxable income so they reduce.

A 0 annual contribution would save 0. Solo 401k Contribution Calculator. You currently have 5000 in your savings account and by saving 100 per month you manage to.

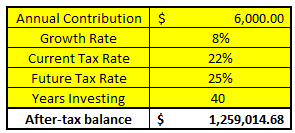

Note that other pre. All contributions and earnings are tax-deferred. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings.

Inform your decisions explore your options and find ways to get the most from your 401k 401k Contribution Calculator Contributing to your workplace. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged. A 401k can be one of your best tools for creating a secure retirement.

Your 401 k contributions directly reduce your taxable income at the time you make them because theyre typically made with pre-tax dollars. May be indexed annually in 500 increments. You only pay taxes on contributions and earnings when the money is withdrawn.

Build Your Future With a Firm that has 85 Years of Retirement Experience. 401 k 403 b 457 plans. A 401k Plan is an employer-sponsored retirement plan that comes with impactful tax advantages.

35000 - 2100 32900. Step 6 Determine whether an employer is contributing to match the individuals. Ad Discover The Benefits Of A Traditional IRA.

How 401 k Deductions Work. First all contributions and earnings to your 401 k are tax deferred. First all contributions and earnings to your 401k are tax-deferred.

This calculator has been updated to. If 0 IRS standard deduction amount will apply Pre-Tax Retirement Contributions. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

How to use the Contribution Calculator. A 401 k can be one of your best tools for creating a secure retirement. Ad Maximize Your Savings With These 401K Contribution Tips From AARP.

For example if you made 30000 last year and put 3000 in your retirement plan account on a pre-tax basis your taxable income for the year would have been 27000. 000 paycheck 00 I want to contribute. You live in a mid-sized city lets say Tulsa Oklahoma where you earn 45000 per year.

You only pay taxes on contributions and earnings when the money is withdrawn. The maximum contribution amount that may qualify for the credit is 2000 4000 if married filing jointly making the maximum credit 1000 2000 if married filing. It provides you with two important advantages.

On a before-tax basis to my qualified retirement account. Protect Yourself From Inflation. Build Your Future With a Firm that has 85 Years of Retirement Experience.

Your 401k plan account might be your best tool for creating a secure retirement. Using our retirement calculator you can see the potential return on 401k contributions and how close you may be to your retirement goals. Pre-tax Contribution Limits 401k 403b and 457b plans.

It provides you with two important advantages. Step 5 Determine whether the contributions are made at the start or the end of the period. The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up contribution every year for participants age 50 or older.

Learn About 2021 Contribution Limits Today. Ad Strong Retirement Benefits Help You Attract Retain Talent. Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

Learn About 2021 Contribution Limits Today. Use this calculator to see how increasing your contributions. Ad Discover The Benefits Of A Traditional IRA.

401 K Calculator See What You Ll Have Saved Dqydj

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Traditional Vs Roth Ira Calculator

Roth Vs Traditional 401k Calculator Pensionmark

The Average 401k Balance By Age Personal Capital

What Is A 401 K Why Do You Need One Complete Guide For Beginners Retirement Savings Plan Saving For Retirement Investing For Retirement

What Are The Maximum 401 K Contribution Limits Money Concepts 401k Saving For Retirement

The Ultimate List Of Tax Deductions For Online Sellers Tax Deductions Business Tax Deduction

401k Contribution Limits And Rules 401k Investing Money How To Plan

Looking For Secure Retirement A 457 Plan Could Be The Best Tool For Creating A Secure Retirement Use Our 457 Retirement P How To Plan Finance Blog Retirement

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

Download 401k Calculator Excel Template Exceldatapro

401k Contribution Calculator Shop 56 Off Www Ingeniovirtual Com

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Pin On Personal Finance

Calculator Calculator Financial Planning Planning Tool

Retirement Savings Spreadsheet Spreadsheet Stock Trading Strategies Saving For Retirement